Have you ever wondered how much $28 an hour adds up to in a year? Knowing your annual salary helps you plan your finances better. In this article, we will break down the calculation for you.

How to Calculate Annual Salary from Hourly Wage

To find out your annual salary from an hourly wage, you need to know a few things:

- Hourly wage

- Number of hours worked per week

- Number of weeks worked per year

For most people, a typical work week consists of 40 hours. There are 52 weeks in a year. Let’s use these numbers for our calculations.

Basic Calculation

Here is the basic formula to calculate annual salary:

Annual Salary = Hourly Wage × Hours per Week × Weeks per Year

Let’s plug in the numbers:

Annual Salary = $28 × 40 × 52

When you multiply these numbers, you get:

Annual Salary = $28 × 40 × 52 = $58,240

So, if you earn $28 an hour and work 40 hours a week, you will make $58,240 a year.

What About Overtime?

Sometimes, you may work more than 40 hours a week. This is called overtime. Overtime pay is usually higher than regular pay. Most companies pay 1.5 times the regular hourly rate for overtime.

Let’s calculate the annual salary with some overtime. Suppose you work 10 extra hours a week. This means you work 50 hours a week in total.

Overtime Calculation

First, calculate the regular pay for 40 hours:

Regular Pay = $28 × 40 = $1,120

Next, calculate the overtime pay for 10 hours:

Overtime Pay = $28 × 1.5 × 10 = $420

Now, add the regular pay and the overtime pay:

Total Weekly Pay = Regular Pay + Overtime Pay = $1,120 + $420 = $1,540

Finally, calculate the annual salary with overtime:

Annual Salary with Overtime = Total Weekly Pay × 52 = $1,540 × 52 = $80,080

So, if you work 50 hours a week, you will make $80,080 a year.

Part-Time Work

What if you work part-time? Let’s say you work 20 hours a week instead of 40.

Part-time Calculation

Here is the formula to calculate the annual salary for part-time work:

Annual Salary = Hourly Wage × Hours per Week × Weeks per Year

Let’s plug in the numbers:

Annual Salary = $28 × 20 × 52

When you multiply these numbers, you get:

Annual Salary = $28 × 20 × 52 = $29,120

So, if you earn $28 an hour and work 20 hours a week, you will make $29,120 a year.

Credit: www.howtofire.com

Impact of Taxes

Keep in mind that the numbers we calculated are before taxes. Taxes can take a big chunk out of your paycheck. The amount of tax you pay depends on your income and where you live.

Let’s look at an example. Suppose you are single and live in the United States. You earn $58,240 a year. According to the IRS, the federal tax rate for this income is 22%. You also need to pay state taxes. Let’s say the state tax rate is 5%.

Tax Calculation

First, calculate the federal tax:

Federal Tax = Annual Salary × Federal Tax Rate = $58,240 × 0.22 = $12,812.80

Next, calculate the state tax:

State Tax = Annual Salary × State Tax Rate = $58,240 × 0.05 = $2,912

Now, add the federal tax and the state tax:

Total Tax = Federal Tax + State Tax = $12,812.80 + $2,912 = $15,724.80

Finally, subtract the total tax from the annual salary:

After-Tax Salary = Annual Salary – Total Tax = $58,240 – $15,724.80 = $42,515.20

So, after paying taxes, you will take home $42,515.20 a year.

Frequently Asked Questions

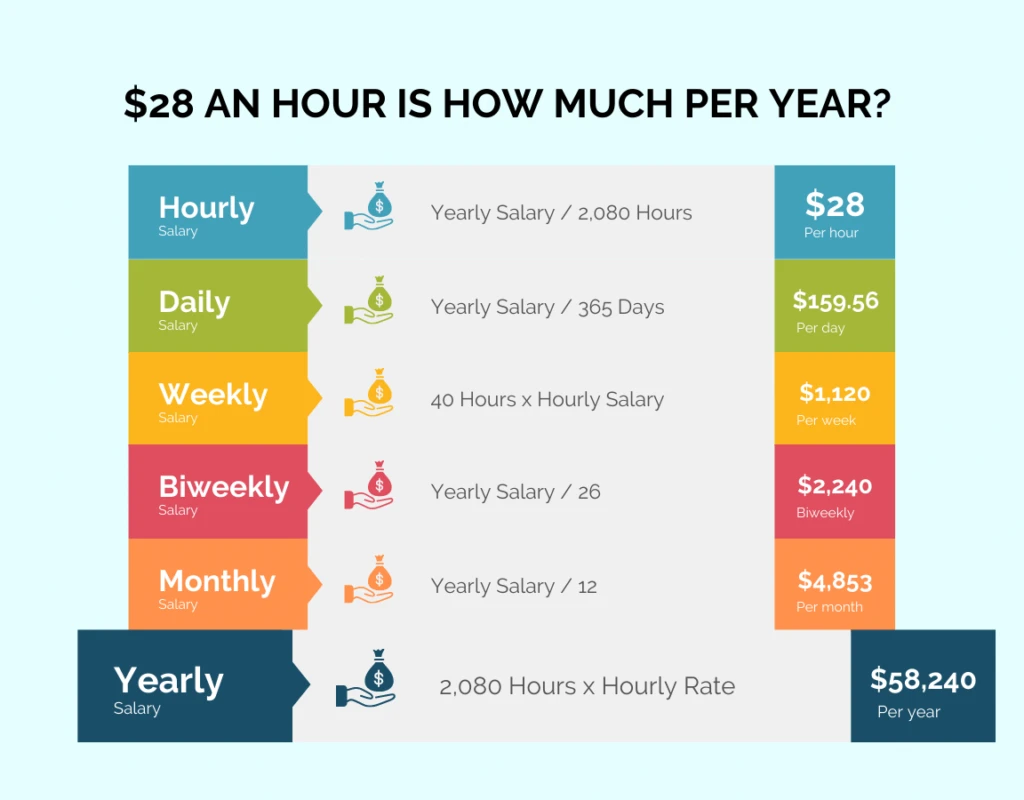

How Much Is $28 An Hour Annually?

$28 an hour equals $58,240 annually, assuming a 40-hour work week and 52 weeks in a year.

What Is The Monthly Income At $28/hour?

At $28 per hour, the monthly income is $4,853. 33 before taxes, based on a 4-week month.

How Much Is $28 An Hour Biweekly?

Biweekly earnings at $28 per hour are $2,240, assuming a 40-hour work week.

What Is The Weekly Pay At $28/hour?

Weekly pay at $28 per hour is $1,120, based on a 40-hour work week.

How Many Working Hours In A Year?

A full-time employee works 2,080 hours annually, assuming a 40-hour work week.

Is $28 An Hour A Good Wage?

$28 an hour is a competitive wage, offering a good standard of living in many regions.

Conclusion

In conclusion, if you earn $28 an hour and work 40 hours a week, you will make $58,240 a year before taxes. If you work overtime, your annual salary can increase significantly. For part-time work, your annual salary will be lower. Always remember to consider taxes when planning your finances.

We hope this article helped you understand how to calculate your annual salary from an hourly wage. Knowing your annual salary can help you manage your money better and plan for the future.

Credit: bundleloan.com

FAQs

| Question | Answer |

|---|---|

| How many hours do I need to work to make $58,240 a year at $28 an hour? | You need to work 40 hours a week for 52 weeks a year. |

| How much is $28 an hour annually with overtime? | If you work 50 hours a week, you will make $80,080 a year. |

| How much is $28 an hour annually for part-time work? | If you work 20 hours a week, you will make $29,120 a year. |

| How do taxes affect my annual salary? | Taxes can reduce your take-home pay. The amount depends on your income and tax rates. |

Thank you for reading! If you have any questions, feel free to ask in the comments below.

Rakib Sarwar is a seasoned professional blogger, writer, and digital marketer with over 12 years of experience in freelance writing and niche website development on Upwork. In addition to his expertise in content creation and online marketing, Rakib is a registered pharmacist. Currently, he works in the IT Division of Sonali Bank PLC, where he combines his diverse skill set to excel in his career.